AI in Corporate Treasury

Generative Artificial Intelligence capabilities continue to evolve rapidly, and the impact it could have on the payments industry – and corporate treasury in particular – is no exception.

From startups to legacy brands, you're making your mark. We're here to help.

Key Links

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

Key Links

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

Key Links

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

A uniquely elevated private banking experience shaped around you.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

For Companies and Institutions

From startups to legacy brands, you're making your mark. We're here to help.

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

For Individuals

A uniquely elevated private banking experience shaped around you.

Whether you want to invest on you own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

Unlock previously hidden insights, make more informed decisions and better manage your bottom line with our access to payment data and AI and machine learning talent and technology.

Domino's Pizza: Treasury Today’s 2024 Adam Smith Award for Best Cash Flow Forecasting Solution Overall Winner1

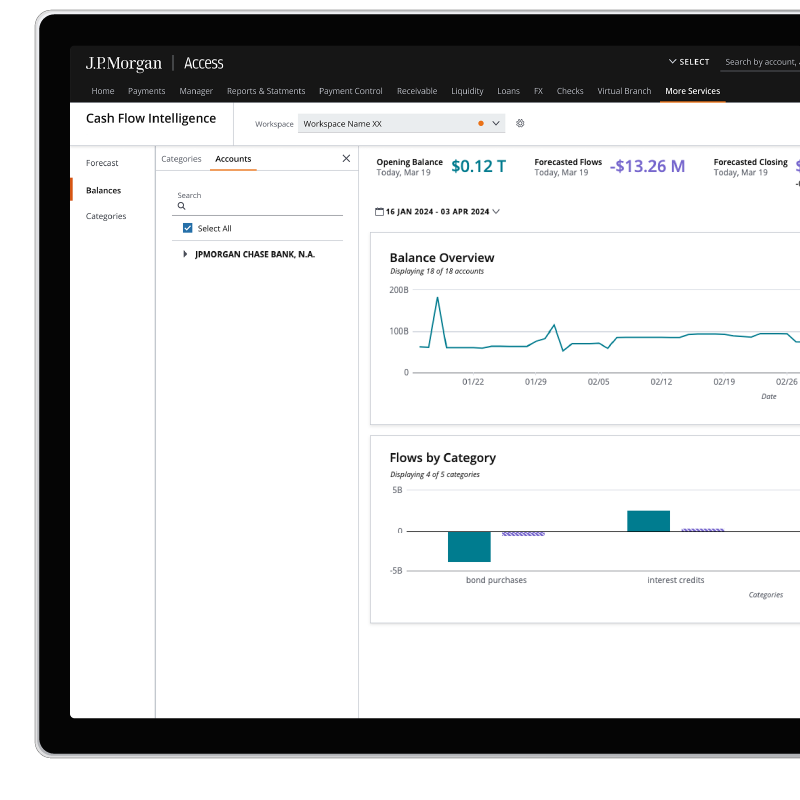

Domino’s turned to Cash Flow Intelligence, a cutting-edge J.P. Morgan platform designed to revolutionize cash flow reporting, resulting in unlocked efficiency, enhanced visibility and improved financial planning.

Leverage innovative solutions powered by the scale and reliability of one of the world’s largest banks with the agility and ingenuity of a fintech.

Customer Insights*

Guide location strategy and marketing efforts, build loyalty and drive informed operational decisions through a better understanding of your customer base and your performance relative to industry peers.

Treasury Insights

Strengthen cash flow accuracy and find previously invisible patterns via cutting-edge technology, powered by AI and machine learning.

Merchant Insights

Enhance authorization rates, better manage your disputes, minimize fraud, mitigate card-testing attacks and more.

Navigate rapidly changing economic environments with the bank ranked #1 for overall artificial intelligence capabilities on the Evident AI Index.2 And as one of the world’s largest payments processors, moving nearly $10T in payments every day, we can help enhance your business and connect you to the world.3

Treasurers

Enhance the corporate treasurer experience by making complicated data more accessible while improving productivity, efficiency and the overall customer journey.

Chief Marketing Officers

Make data-driven decisions with an on-demand view of customer preferences and loyalty behavior, track competitor positioning and build tailored marketing programs.

Heads of Product

Better understand your customers' needs in order to drive efficiency and product development projects.

Generative Artificial Intelligence capabilities continue to evolve rapidly, and the impact it could have on the payments industry – and corporate treasury in particular – is no exception.

Treasury Insights

Organize, analyze and forecast your cash in the way that works best for your business.

Customer Insights

Unlock your business’ full potential with a better understanding of your customer base and your performance vs. peers.

Merchant Insights

Increase authorization rates, minimize payments-related costs and mitigate the impact of disputes on your business.

Trust & Safety

Validate your accounts and proactively boost your defense for all your end-to-end payments.

J.P. Morgan Access®

Empower your business to thrive with treasury tools that help you manage your business and working capital.

Commerce

Transform B2C and B2B experiences with the next generation suite of commerce payment solutions by J.P. Morgan Payments.

LET'S TALK

Hide

LET'S TALK

Hide

*Future capabilities of Customer Insights are under development; features and timelines are subject to change at the Bank’s sole discretion.

© 2024 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. Deposits held in non-U.S. branches are not FDIC insured. Non-deposit products are not FDIC insured. The statements herein are confidential and proprietary and not intended to be legally binding. Not all products and services are available in all geographical areas. Visit jpmorgan.com/paymentsdisclosure for further disclosures and disclaimers related to this content.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.